Allison LaMarr: Fastest to Million, Fastest to Broke?

Have you ever wondered what life is like at the top of Mary Kay? Look no further than the standout beauty consultant Allison LaMarr, who quickly rose to fame within Mary Kay, and was put on a pedestal by corporate and sales directors.

Have you ever wondered what life is like at the top of Mary Kay? Look no further than the standout beauty consultant Allison LaMarr, who quickly rose to fame within Mary Kay, and was put on a pedestal by corporate and sales directors.

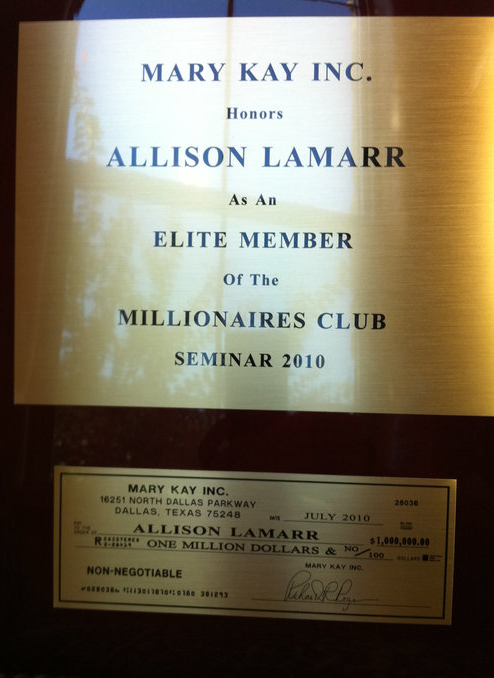

We have documented on Pink Truth the meteoric rise of Allison LaMarr to the position of National Sales Director for Mary Kay Cosmetics. While being the fastest to reach NSD, she was also the fastest to quit. And now Mary Kay has sued Allison and her company Driven Inc. (also involving her husband James LaMarr) for breach of the NSD contract.

But was the fastest to reach “million dollar earner” status in Mary Kay Inc. also the fastest to broke? The evidence of Allison’s downward spiral into financial hardship mounts, and this post is going to summarize what is known to date.

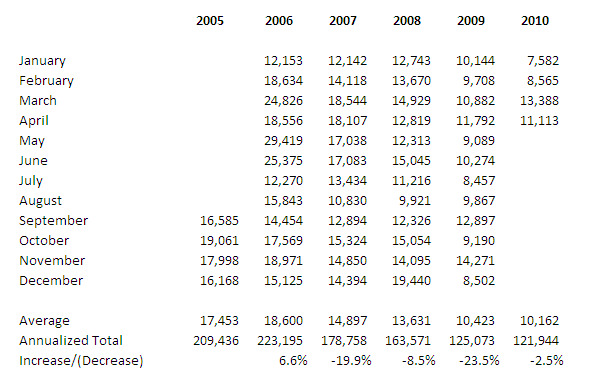

This is what Allison’s commissions and bonuses looked like in Mary Kay:

Here was the big Mary Kay superstar, and her earnings were tanking. While I’m sure that there are plenty of people who would be happy earning $120,000 per year ($10,000 per month), there are a few important points to consider:

- This was GROSS income. All business expenses had to be paid out of this, substantially reducing what is left to feed the family. As you can see in this post, Allison likely had $40,000 to $55,000 cash left each of the last two years with which to support her family.

- You can see her income peaked at $223,000 and then steadily fell from there.

- This is the highest position in Mary Kay. This is what tens of thousands try to achieve each year, and almost none actually succeed.

As Allison’s income was falling, Mary Kay’s patience seemed to be running out, and her financial troubles became apparent.

In late 2008, the house owned by Allison LaMarr and James LaMarr was put on the market. By that time, Allison’s national area was down to only 14 sales directors (20 directors needed to enter and complete National in Qualification, but no minimum requirement after being appointed to NSD).

There was intense speculation that the home was being sold because Allison could no longer pay for it. She ended up telling the Mary Kay community that she and James were selling the house so they could move away and help start a church.

It now appears that the speculation about her inability to afford the house was right on target. According to Travis County, TX public records:

The LaMarrs owned a 3,600+ square foot home at 1426 Lofty Maple Trail, in Kingswood, Texas that they sold for $427,063 on 4/23/07. This home was originally purchased in 2005 for $308,560, with mortgages totaling $290,000 at the time of purchase.

The LaMarrs owned a 3,600+ square foot home at 1426 Lofty Maple Trail, in Kingswood, Texas that they sold for $427,063 on 4/23/07. This home was originally purchased in 2005 for $308,560, with mortgages totaling $290,000 at the time of purchase.- Despite Allison’s Mary Kay earnings being substantially lower in 2008 than 2006 or 2007, Allison and James LaMarr thought it prudent to get a new, expensive house.

- They purchased a 5,000+ square foot home at 8201 Denali Parkway #3 on 7/25/07 for $1,307,722, with mortgages totaling $983,250. The first mortgage was at a 30 year note at 7% interest.

- The home was sold by the LaMarrs on 12/1/08 for $412,500, or $895,222 less than they paid for it. Liens by the lender JPMorgan Chase Bank were released.

- It is unclear how the unpaid balance on the mortgage was satisfied. While it would be possible for the bank to write off the difference, it seems that this would be too substantial an amount for the bank not to pursue. I have not found any court records indicating a suit or judgment against the LaMarrs, nor have I found any bankruptcy court records that would explain it.

A 30 year mortgage of $983,250 at 7% would require a monthly payment of $6,542 if both principal and interest were being paid. If only interest was being paid, that would still be a monthly payment of $5,736. Annual payments on the mortgage alone would have totaled $69,000 to $78,000 per year. Property taxes in 2011 were approximately $22,000, so it is clear why Allison sold the house only a year and a half after purchasing it…. she couldn’t pay for it.

If that wasn’t bad enough, Allison and James LaMarr had tax troubles on top of that. On November 29, 2010, the Internal Revenue Service assessed taxes, interest, and penalties for unpaid personal income taxes for 2009. On April 22, 2011, the IRS filed a tax lien against James and Allison LaMarr for $37,315, the unpaid balance on the 2009 taxes as of that date. The lien was withdrawn on May 27, 2011, suggesting that the debt was paid.

It is impossible to know how much of that $37,315 balance was income taxes (versus penalties or interest) or what the Lamarr’s total tax bill was for that year. It is clear, however, that this is just one more indication of the dire financial condition Allison and James LaMarr may have been in.

And then there’s the little matter of Murray Smith. He is the guy that Allison hired to help her make millions as a motivational speaker, trainer, and business coach…. for the bargain price of $50,000:

I’m sure Allison told everyone about the $50,000 to (a) make it seem like she was still financially successful and had this amount of money available, and (b) give the impression that the training was super-duper and everyone should buy her materials because of it.

So at a time when the Lamarrs were unable to pay for their home or pay their taxes, Allison was paying $50,000 to some guy who was going to teach her the secret of making millions “coaching” and “training” people. It seems this investment did not pay off, as Allison eventually took a job with MLM Bellamora, then went onto MLM Seacret Direct in a corporate position, and now is a representative for Seacret and is recruiting a downline.

This, my friends, is what extreme success in Mary Kay (and other MLMs) looks like. Claw your way to the top, and still fail to consistently make “executive income.” I can anticipate the responses from Mary Kay supporters: Allison is one person. She’s just a bad apple. She’s an exception.

Except she’s not. The earnings you see are typical for the people at the top of the pyramid. Mary Kay and its sales directors sang Allison’s praises, saying that if she could succeed (and do it so fast), then anyone could do it. She was held up as the example of someone “doing it right.” Everyone wanted her training and guidance.

Buyer beware. Allison is not the kind of example you want to follow.

Visit the

Visit the

Allison believed her own hype! So sad, she duked herself with it.

How can a company sue a woman for something she created for use in ‘her own business?’ Wasn’t Allison an independent contractor as an IBC? As an NSD? Are NSD’s employees of corporate? I don’t understand how mk can sue someone who is in business for herself. It’s not like Allison is using the mk logo or catch phrase.

She was reportedly using e-mail lists and material that she had confidential access to as an NSD … and her contract had a 2-year “thou shalt not use” clause on it. That’s a reasonable time for a non-conmpete clause.

And accordingto the lawsuit, she was using those e-mail lists to recruit for her new MLM.

Ah. I see. She basically disregarded the stipulations set for in the contract she signed and now has to stand accountable for those actions of disregard. Got it.

Oney – She agreed not to do that when she signed the NSD contract. I’m not saying that contract is good. It is very much for MK’s benefit. Nonetheless, she voluntarily signed it and therefore agreed to its terms.

Haha…hahahahahahhahahahaha ha hahha hah ha ha

How the mighty have fallen. Guess that’s what happens when the pedestal is made of sand and sequins.

The real tragedy here, is all the women who were made to feel like dirt because they couldn’t match Allison’s success.

It is flippin ironic, isn’t it? And that’s how the whole game is, all the way up the career path. You simply do not find out what is true until you get there…and they hope you are in so deep and so brainwashed that telling the “truth” won’t be an issue.

Funny to think how many NSDs and SDs are reading all of this on PinkTruth because it’s the only way they can find out what’s going on.

RJ- you are so right- the truth isn’t spoken out in the pink bubble because ‘it’s negative’, so the only way for any of them to see what’s going on is this wonderful website! Amazing!

Oh man…someone posted on the Dirty that she was a scam artist (moosemama found it some months ago), and had tons of debt. This says so much! It may not be the whole story, but it’s a good enough portion. Methinks too this is why they may have split up.

I’m seriously beginning to think Allison suffers from narcissism and some kind of mania, if not full blown bipolar. If I am right, it’s sad that it’s gone unchecked and led her this far.

http://thedirty.com/2011/07/allison-lamarr-is-a-career-scam-artist/ read the comments

“So at a time when the Lamarrs were unable to pay for their home or pay their taxes, Allison was paying $50,000 to some guy who was going to teach her the secret of making millions “coaching” and “training” people.”

It’s no wonder that Lamarr continually speaks of having a spirit of unrest and striving to not settle for a “good” life when she could have a “great” one. She’d be able to enjoy a good, contented life if she’d just STOP SPENDING MONEY SHE DIDN’T HAVE.

I’m reminded of an NSD speech Lamarr gave in 2007 describing her going to a MK Fall Advance. Understand that in the same speech, Lamarr laments being married just three years and having racked up $30,000 in credit card debt:

“Thank God, my director called me and invited me to come to the Fall Advance in Colorado. I was living in TX and if you have ever bought a plane ticket for the next day, you know how expensive that can be! With all the credit card debt I had, what did it matter? I had to own it and take responsibility! So I went!”

Sure! With all the credit card debt you had, what did it matter? Own that debt, take responsibility, and dig yourself even deeper into that hole!

What Tracy said. This is not the sort of star ANY woman should hitch her wagon to.

“I’m seriously beginning to think Allison suffers from narcissism and some kind of mania, if not full blown bipolar. If I am right, it’s sad that it’s gone unchecked and led her this far.”

After suffering through watching some of her videos, I could totally agree that she’s narcissistic and bi-polar. Many years ago I dated someone that I eventually realized was a full-blown narcissist. Holy cow, he thought he was the best thing since sliced bread (much like Allison) and would tell everyone who would listen that he “was the best that there is and the dream of every American woman…” (he was Egyptian). Everything he did, every thought he shared, word he spoke, item he owned was “the best that there is.” In hindsight, I could look back and see how he fit the classic narcissist mold. Creepy. And so much like Allison.

I’m married now – to a super down-to-earth man with the sweetest heart – but his ex-wife. Double holy cow – she’s bi-polar. She’s up. She’s down. She’s all over the map with one crazy idea/project after another. Or she’s sleeping for days. The manic phases remind me of Allison in her videos – all her, all the time.

Ugh.

Methinks that Allison must have done a short sale on the second house she owned. Not as bad as a foreclosure, but just about. She would have needed to prove that she could no longer financially afford to pay for the house after turning in information about her income and expenses to the bank. Why are there still women following this sham artist? Why would I want to be like her? She can’t pay her bills, she can’t keep a job, her marriage has dissolved, and the list goes on.

I thought the same thing, but I have a hard time believing the bank would just write off over $850k and not try to collect at least some of it. I was expecting to at least see a judgment for part of the difference. I wonder if Allison’s family had some money that was used to satisfy the balance left on the loan.

The other factor that leads me to believe that it was NOT a short sale was how quickly the sale closed. It was actively listed for sale in November, and closing was at the beginning of December. Short sales usually take a long time to process. Especially in this case – – with such a large loss on the home – – I would think the bank would want to wait and see if any better offers came through before just writing off the loss.

Hmm.creative financing?? Perhaps this is one of those 1/3 cash, 1/3 paid by family, and 1/3 assumption of the mortgage by grandma. You know…the Government Unawareness Plan?

ROFLMAO!!!!!

…..the Government Unawareness Plan?

Raisin Rocks!!!

the problem for Allyson is that she tried to build a business that uses an old business plan, by following a different business plan strategy. Mary Kay is one of the oldest direct sales companies, and thus uses the ‘old’ business model of network marketing; breakaway stair step compensation plan. it worked well in those decades, but later on things changed to different models that provided more income with less inventory and still sales to clients; those are binary, etc. (for more detail on the types of comp plan see http://www.mlmlegal.com/sizing.html )

the MK comp plan model does not work because it relies on orders not sales. if they had a preferred customer (real one) system to promote for those not wanting the biz discount, then they would be much better out there some how.

nowadays, we have companies that are not only binary, and mixed comp plans, but companies that truly promote client programs as equally or as much as recruiting biz builders. are they all perfect? No. these are business models just like affiliate marketing, commision junctions, ebay, etc.

the advantages i personally see of NM/DS is that the company takes care of stocking inventory, delivery, shipping, taxes, etc. Whereas to do it all yourself, as a business owner, it will cost you hundreds of thousands of dollars. period.

the downfall, is when greed enters the picture and people recruit without heart. the other downfall is old companies trying to maintain a model that does not work; ie Mary Kay, etc.

kind regards

former consultant.

Former Nationals. That’s all anyone needs to know to stay away from MK.