Chelsea’s Mansion

Remember in June of 2021 when Jamie Taylor got her downline to max out their credit cards so she could make it to nsd in Mary Kay?

The longer video of Jamie blubbering about her downline making terrible financial decisions for Jamie’s personal benefit starts with her gushing about Chelsea Claytor Adkins. (This is the woman who proves that any idiot can become a Mary Kay director.)

Jamie goes on and on about how Chelsea was building a “literal mansion” all thanks to MK:

A couple of years ago Chelsea like had no money… unwell… she was cheating on her Mary Kay business and went and got another job. But she didn’t quit. She didn’t quit. She just didn’t quit. And right now she’s building her dream home, like a literal mansion. It’s like twice the size of my house. She’s building it. She got approved for the loan you guys. She’s doing it. She’s doing it. All she had to do was not quit.

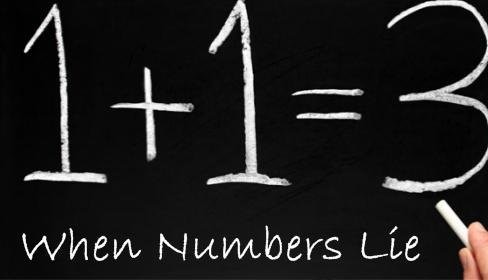

As usual, that was a total lie. And we knew it. Chelsea isn’t making the big money they want you to think she’s making. She sells her products at nearly her cost, so there is no profit there. Chelsea has had maxed out credit cards for years. She bought her way into her first Cadillac. And then when her unit had to requalify for the Cadillac last year, Chelsea told the lie that it was so easy, even though her unit rarely does Cadillac level production.

In Feburary, Chelsea Claytor (not Adkins, because she’s too irresponsible to find the documents required to change her name to her married name) and her husband Zachery Adkins finally bought a house after getting evicted from the last house they pretended to own.

But its not the mansion Jamie wanted you to believe they were building. It’s a 1,300 square foot house in Rocky Mount, Virginia. Chelsea and Zach bought it for $230,000 on January 3, 2022. Their mortgage amount on that date was $225,834, which means they probably barely scraped together $10,000 for a down payment on it.

It’s a cute little house that was built in 2020. And they’ve got an acre of land. The house has 2 bedrooms, 2 bathrooms, and a little office. But I’m afraid it’s far from being a mansion.

It’s a cute little house that was built in 2020. And they’ve got an acre of land. The house has 2 bedrooms, 2 bathrooms, and a little office. But I’m afraid it’s far from being a mansion.

And the fact that Chelsea and Zach could barely scrape together a down payment tells you about all you need to know about the not-so-big money Chelsea is earning in MK. (Especially since they spent the past year living in Chelsea’s mommy’s house.)

Visit the

Visit the

#1 you are CRAZY to buy a house if you are not selling one right now in this market or have enough savings like $25- $30K to put down…

Along with being MK poor they are now house poor. I am not even sure which one is worse… Yes there’s an acre of land with it’s but once the market sinks they will never break even om it.

Also my 100yr+ old farm house has 38 more square feet, so I must also own/ live in a mansion!!

That’s a perfectly respectable home for first-time buyers. It’s too bad they felt the need to lie and self-aggrandize about their plans. Maybe her unit members with a shred of common sense will realize that Chelsea is not all she claims to be.

It is a respectable home. It’s also pathetic that they couldn’t come up with any more than $10k for a down payment, especially given all her bragging about the BIG MONEY she’s making in MK.

Fake it ’til You Make is the MK way.

Cute house Chelsea! Should we give it a name? Chateau CoPay?

Château Çôpæÿ

Looks she bought a mansion just like training is free in Mary Kay, and you earn executive pay for part-time work, and the products sell themselves.

But, yes, there’s nothing wrong with that house, it’s just not a literal mansion or dream home, like claimed. I suppose it’s possible Chelsea & her husband started talking to builders & found out what they wanted was WAY more expensive than they thought.

“It’s a literal MANSION you guys!”

Hmm…two bedrooms and a little office. Any basement or attic? Where oh where will all of her inventory go?

Not to customers for full retail price

Odds are that both of their cars go in the driveway and that tiny one car garage is stacked up with inventory.

wonders about snow shelters for cars in Virginia…

A whole new level of financial responsibility: mortgage payments, homeowner insurance, property taxes, maintenance expenses, etc.

Our first home was purchased in 1995 in southern Georgia for $72,200. It was a three-bedroom, two-bath home with around 1300 square feet. We lucked out and got a corner lot on the lake. Yes, it was a new construction home. No, we didn’t have down payment money; we used hubby’s VA funding (he’s now retired Navy). It was by NO means a mansion. We forced ourselves to stay within a tight budget so we wouldn’t end up house poor.

I tell that story because we watched several of our friends buy homes in the area that were at the top of their budgets. Like us, there were some first-time homeowners’ mistakes (blinds don’t generally come with new construction, and that pretty wood floor you want is going to cost extra). But they charged up new furniture and such on credit. Yes, they, too, were Naval officers, and until we all got promoted at close to the same time, they lived paycheck to paycheck. We didn’t.

So Chelsea, pay heed to what others with a lot more experience have been through. I applaud you and your husband and your home purchase. However, don’t lie to everyone about it. It’s not a mansion, not even in the western part of Virginia.