Mary Kay Market Saturation

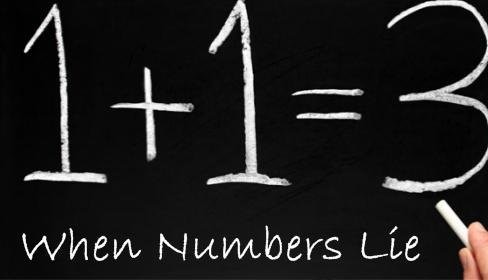

A common question about Mary Kay Cosmetics is, “Is the market saturated?” Here we explore the real market for the products and whether or not Mary Kay is a viable business opportunity. I submit that yes, the market is saturated with Mary Kay Cosmetics, and the chances of making a living selling the products are next to none.

A common question about Mary Kay Cosmetics is, “Is the market saturated?” Here we explore the real market for the products and whether or not Mary Kay is a viable business opportunity. I submit that yes, the market is saturated with Mary Kay Cosmetics, and the chances of making a living selling the products are next to none.

Market Saturation: a term used to describe a situation in which a product has become diffused (distributed) within a market; the actual level of saturation can depend on consumer purchasing power; as well as competition, prices, and technology.

So in Mary Kay, the market is “saturated” when the people who can afford the product and who actually want to buy the product have done so. This is determined by market share.

Brand (or market) share: This is the share of overall ‘market sales’ taken by each brand. The results of Andrew Ehrenberg’s research have complicated matters further. He shows that – unlike the traditional view that customers buy just one brand – they actually buy a ‘portfolio’ of brands. Their brand loyalty is, therefore, measured in terms of the share of overall purchases over time, within that portfolio, held by the brand in question!

The measure of share, and the concept of prospects, are important because they delineate the extra business that a producer can reasonably look for, and where he or she might obtain it. On the other hand, the evidence in many markets is that most business comes from repeat purchasing by existing customers.

So once your potential customer base has purchased the product, you have to depend on brand loyalty (for the most part) to keep your sales stagnant.

So here are some numbers on Mary Kay. (Let’s not forget that Mary Kay competes against pretty much every other makeup brand out there, including other direct sellers like Avon and Arbonne.)

There are roughly 167 million females in the United States. If you remove women in poverty and those under the age of 18 and over the age of 80, you have about 102 million women who would consider buying Mary Kay products.

Then you have to consider all the millions of former MK consultants who want nothing to do with the company. And the women who have already tried the products and don’t want to use them. But let’s be optimistic and leave everyone in.

There are about 400,000 MK consultants in the U.S. That means there are at most 255 potential customers per representative. Except there is competition from a zillion other brands. How many of those 255 people would use MK consistently and for a long period of time? How much will each person spend? How can a consultant build a downline that will earn her a substantial income with only 255 potential recruits?

This is why multi-level marketing sucks. (There are lots of other reasons, too, but this is one of the biggest.) Mary Kay sells unattainable dreams, and they encourage each new rep to buy tons of inventory, all to keep the pyramid from crumbling. And when the numbers get too dire, they just export the whole racket to another country.

The only people who got rich at this business are Mary Kay Inc. and the women who got in at the top of the pyramid.

Visit the

Visit the

Brand loyalty and brand portfolio are two concepts that MLMs and MKs routinely misunderstand, particularly when discussing saturated markets.

Look around your home at the different products you buy: cleaning, laundry, cosmetics, undergarments, workout gear, cookware — you name it. We are loyal to specific brands due to quality, price/value, efficiency, comfort, and any other category you might think. My laundry supplies are a mix of companies because I choose the best item for each use (stain treat, detergent, etc.). My cosmetics are a hodge-podge of many brands since each brand has different things I like with a wide range of price points. My cookware is a mix of LeCrueset, All-Clad, and Lodge cast iron. Could any of the brands I purchase routinely be considered “saturated?” Nope. Not even close.

MK, on the other hand, has consultants and former consultants everywhere. Just in my neighborhood alone, there are FOUR former consultants (including me). Can I find FOUR LeCrueset sellers in the same shopping center/mall? No. I can think of three brick-and-mortar stores within about 20 minutes of each other that sell Le Crueset. (I didn’t count online retailers since there are dozens of sellers.) LeCrueset tracks its sales with each retailer. MK ONLY tracks what it sells to consultomers, NOT what is actually sold. There are hundreds of thousands of dollars of rotting MK inventory out there that no one wants. I am pretty sure that cannot be said for LeCrueset.

The Mary Kay Market has been saturated for years! They’re just recycling people at this point. They think they can attract a younger market. As if!

Multi-level marketing and direct sales are inherently flawed because it places no limit on the number of sales representatives being recruited. Cosmetic companies that sell through retail will have sales representatives to meet with and show their products at the various retail store chains, but they limit the number they hire and those sales representatives do not recruit anyone as that is not their job. Some cosmetics companies may sell directly to the public in addition to or instead of through stores but they have only one “sales rep” for that – their website (well, they may also sell through Ebay or other marketplace facilitators as well but the websites are not recruiting anybody to sell). The typical non-MLM company will always be limiting the number of sales representatives they have in any case.

Contrast with MLM where you sell the products and recruit others to sell them because of the commissions you get from your downline and it doesn’t take long before there are too many sales representatives and nobody is making any money. In what world does it make sense to recruit and train your own competition (or future replacement) anyway? It’s great for the MLM company themselves – brings their recruiting and training costs to zero – lousy for anyone who wants to sell their crap. There are eight Mary Kay reps within just a few miles of where I live and I doubt any of them are making much of anything.

I swear there was a comment made when I was in that each church could support a consultant. So if you had had 5 churches in town, you could have 5 consultants. I’ve never been able to wrap my brain around that.

I was told the the number of banks would support the consultants.

I was told that a town could support as many sales directors as bank branches. The complete idiocy….

At one point, 20-25 years ago, my town of about 10,000 people had at least 10 different banks. Now there are 4, and 2 of those are branches of the same bank (at opposite ends of the main drag).

I can’t imagine the town supporting 3 directors let alone the 10.

The pervasiveness of the internet and the janky economy have done a number on in-person banking as well as MK, but the difference is the successful banks have adapted to the changes, whereas MK is still trying to party like it’s 1969.

Given how many churches are closing and merging, they might want to rethink that.

Many churches, including mine, discourage members from soliciting to other members, especially MLMs.

The best indicator of saturation is year-over-year gross revenue trends. Mary Kay is a private company, and they don’t report earnings publicly, but my guess is if you look at the US market alone, Mary Kay’s revenues have been steadily falling for the past 10 years, with the only bump coming from the Covid lock-downs. Even a “flat” revenue trend (adjusted for inflation) would mean saturation, but all indications are that Mary Kay’s US revenues are actually shrinking (worse than saturation).

Mary Kay may be growing internationally, as most MLMs branch out once their US market is saturated. Anyone who says geometric growth is possible (recruit 5 who recruit 5 who recruit 5 etc.) are belied by the company’s own revenue numbers year over year. If geometric growth were possible, the company’s YOY revenue numbers would reflect it. But all companies grow logarithmically (in MLM this means 20 can only recruit 10 who can only recruit 5 etc. for example), and every MLM downline is limited, mathematically, to just under “one” direct down-line rep per rep, on average. This limitation applies to every MLM downline. This number (one) cannot be reached or exceeded due to earth’s limited population, and no amount of wishful thinking can change this reality.

For Mary Kay NSDs, “churn” is the name of the game. The last thing an NSD needs is a “stable” down-line. If you are not bringing in new folks, you are missing out on the revenue from that big inventory purchase (front-loading). It would be a nightmare for the NSD to get only the “minimum” from each in their down-line.

Mary Kay’s business model can be summed up as this: “Recruit new people who will purchase substantially more product than they have any hope of selling or using, convince them to recruit others to do the same, and make sure they replace themselves with a new recruit in the downline before the run out of money and quit.”

Outside sales are just window-dressing. The Mary Kay business model has no dependency on outside sales.